INSURANCE BILLING

Simplify Insurance Billing, Accelerate Payments

Insurance billing doesn’t have to be a headache. Curve turns complex claims and payments into a painless process. Our intuitive dental billing software automates tasks, improves accuracy, and gets you paid faster. Simplify how you build, distribute, monitor, and process billing with Curve.

.png?width=170&height=170&name=Testimonial%20Image%20(1).png)

“I haven't found a single system that allows me to create the kind of synergy necessary for clean claims. Curve SuperHero is a custom suite that synergizes all of the key points to allow me to get the result of a clean claim. No more ping pong, all hole in one!”

Cassie Tallon

Founder & CEO of The Fractional Match

Streamline Eligibility Verification for Faster, More Accurate Billing

- Eligibility Verification:

Quickly check patient insurance eligibility with Curve’s verification tools to streamline your billing process and reduce denials - In-Depth Coverage Insights:

Detailed, code-level coverage information lets you provide accurate estimates and enhance patient transparency

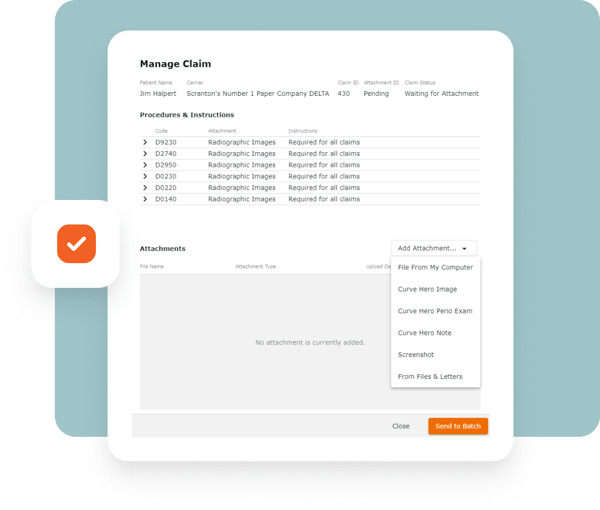

Speed Up Your Claims Process

- Integrated Claim Attachments:

Attach and submit all required claim documents directly within Curve, eliminating the need to switch platforms and reducing errors for faster reimbursements - Smart Pop-Up Alerts:

Get automatic notifications when attachments are required for claims, reducing the risk of missing key documents and speeding up the reimbursement process

Watch this short video to learn how Cassie Tallon, a leading dental industry consultant on operational efficiency, unlocked the key to clean claims with Curve.

4 Ways Curve Accelerates Claim Reimbursement

1

Optimize Your Process With Appointment Tags

By pre-grouping codes for your most frequent visit types, you’re guaranteed an accurate visit with a single click

2

Curve's Best Practices for Accurate Intake

Produce clean claims the first time and reduce back-and-forth with insurance companies

3

Appointment Tags Automatically Sync with Clinical Quick Buttons

Meaning all treatments are properly charted and billed

4

Minimize Write-Offs

And maximize your revenue with fewer mistakes

Clearer Insights, Faster Reimbursement

- Quick eClaim Submission and Tracking:

Submit and track claims at every stage, from clearinghouse to insurance processing to posting the remittance, all with just a few clicks - Electronic Remittance Advice (ERA):

Automatically receive and interpret ERAs, providing clear insight into claim status and reimbursement amounts

Boost Cash Flow with Instant, Error-Free Payment Posting

- Seamless Auto-Posting:

With Curve’s integrated payment solutions powered by Global Payments, insurance payments auto-post directly to the invoice, matching them line by line with the Explanation of Benefits (EOB).

What Auto-Posting Means for Your Practice:

- Auto-posting eliminates the need for manual entry, saving 5-7 mins per patient and reducing errors.

- Faster, accurate posting leads to improved cash flow for your practice.

- Your team can focus on only handling exceptions, not routine payment tasks.

- With precise matches to EOBs, there’s less need for follow-ups with insurance companies.

- Auto-posting ensures payments are accurate, minimizing billing mistakes.

- You get clear, itemized payment insights, making reconciliation easier.

Frequently Asked Questions

Curve offers streamlined claims management with effortless claim attachments and real-time claims status tracking. This means you can easily attach and submit necessary documents and track your claims at every step, reducing delays in payments.

Your Curve subscription includes unlimited claims at no additional cost!